Globally, ALLOW Management Consulting offers transaction services to a variety of industries, including infrastructure (district energy, water, waste, ports, oil storage, and pipeline) and energy (renewables, thermal generation, gas storage, transportation, and electricity networks).

Transactions are a constant reality for companies looking to expand or reposition themselves in the energy and infrastructure sectors. We frequently work with clients who want to buy or sell assets to achieve their goals after conducting a strategic review.

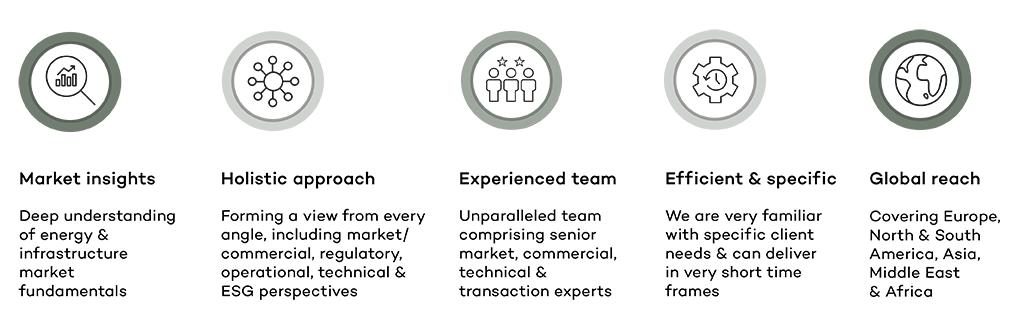

By combining our management consulting and engineering skills, we give our clients deep insights into their goals based on our in-depth knowledge of energy and infrastructure assets and markets.

As we cover the entire range of sell- and buy-side as well as (re)financing advisory from market, commercial, and regulatory to operational, technical, and environmental aspects of each transaction, ALLOW provides a distinctive set of transaction and due diligence capabilities to corporate players, private equity, and infrastructure funds. Our ability to serve as a one-stop shop enables us to give our clients the most impact possible.

In this regard, we assist investors in evaluating the target’s complete potential through due diligence, performance upsides, revenue growth potential, cost reduction opportunities, and asset base quality.

Our diligence In order to address project status (e.g., buy side vs. sell side, project finance), client specificities (e.g., infrastructure funds vs. corporate players), and target particularities (regulated business, new technologies, etc.), scope of work is designed on a case-by-case basis.

Market, Commercial and Regulatory due diligences

Operational due diligences

Technical and environmental due diligences

Technical and environmental due diligences

We can assist all kinds of businesses and investors in the energy and infrastructure sector in Europe, the Americas, the Middle East, Africa, Asia, and Australia thanks to our global reach and local capabilities.

The M&A advisory team at ALLOW Capital, offers clients in the packaging, energy, infrastructure, and forest products sectors independent strategic corporate finance and M&A advice.

Since 2008, we have facilitated transactions totaling over €250 billion.